Aug 3, 2017

GENCOR RELEASES THIRD QUARTER FISCAL 2017 RESULTS

FOR IMMEDIATE RELEASE:

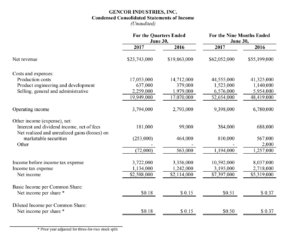

August 3, 2017 (PRIME NEWSWIRE) – Gencor Industries, Inc. (Nasdaq: GENC) announced today net revenue for the quarter ended June 30, 2017 increased 19.5% to $23.7 million from $19.9 million for the quarter ended June 30, 2016. Gross margin was 28.2% for the quarter ended June 30, 2017 compared with 25.9% for the quarter ended June 30, 2016. Selling, general and administrative expenses increased $280,000 to $2,259,000 for the quarter ended June 30, 2017, from $1,979,000 for the quarter ended June 30, 2016. Operating income for the quarter ended June 30, 2017 was $3.8 million compared to $2.8 million for the quarter ended June 30, 2016.

The Company had net non-operating expense of $72,000 for the quarter ended June 30, 2017 compared to net non-operating income of $563,000 for the quarter ended June 30, 2016. Net income was $2.6 million, or $0.18 per basic share and diluted share, for the quarter ended June 30, 2017, compared to $2.1 million, or $0.15 per basic and diluted share, for the quarter ended June 30, 2016.

For the nine months ended June 30, 2017 the Company had net revenue of $62.1 million and net income of $7.4 million ($0.51 per basic share and $0.50 per diluted share) versus net revenue of $55.2 million and net income of $5.3 million ($0.37 per basic and diluted share) for the nine months ended June 30, 2016.

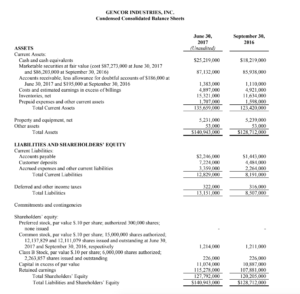

At June 30, 2017, the Company had $112.4 million of cash and cash equivalents and marketable securities compared to $104.2 million at September 30, 2016. Net working capital was $122.8 million at June 30, 2017. The Company has no short or long term debt. The Company’s backlog was $37.9 million at June 30, 2017, compared to $21.4 million at June 30, 2016.

John E. Elliott, Gencor’s CEO, stated, “Gencor had another solid quarter with revenues up 20%, gross margins of 28%, net margins of 11% and a significant increase in our backlog.

Backlog of $37.9 million entering the fourth quarter increased 77% year to year as we closed a number of opportunities after the ConExpo show. Deliveries of equipment are scheduled for the fall and early winter months. This is atypical, as customers historically require delivery of equipment between late winter and spring.

Current quoting activity for fiscal 2018 is encouraging as it is higher than this time last year. We see solid opportunities across all regions of the US and improving activity in Canada.

Steel prices remained stable in the third quarter and we have not seen signs of higher prices in the fourth quarter. We have increased headcount, focusing on expanding our product offerings, improving our cycle times and addressing increased market demand. We will be making additional investments in technology to expand and improve our production capabilities.”

Gencor Industries is a diversified heavy machinery manufacturer of equipment used in the production of highway construction materials, synthetic fuels, and environmental control machinery and equipment used in a variety of industrial applications.

Caution Concerning Forward Looking Statements – This press release and our other communications and statements may contain “forward-looking statements,” including statements about our beliefs, plans, objectives, goals, expectations, estimates, projections and intentions. These statements are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond our control. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and similar expressions are intended to identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. Our actual future results may differ materially from those set forth in our forward-looking statements. For information concerning these factors and related matters, see our Annual Report on Form 10-K for the year ended September 30, 2016; (a) “Risk Factors” in Part I, Item 1A and (b) “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7. However, other factors besides those referenced could adversely affect our results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by us herein speak as of the date of this press release. We do not undertake to update any forward-looking statement, except as required by law.

Contact: Eric Mellen, Chief Financial Officer

407-290-6000