GENCOR RELEASES FIRST QUARTER FISCAL 2023 RESULTS

FOR IMMEDIATE RELEASE:

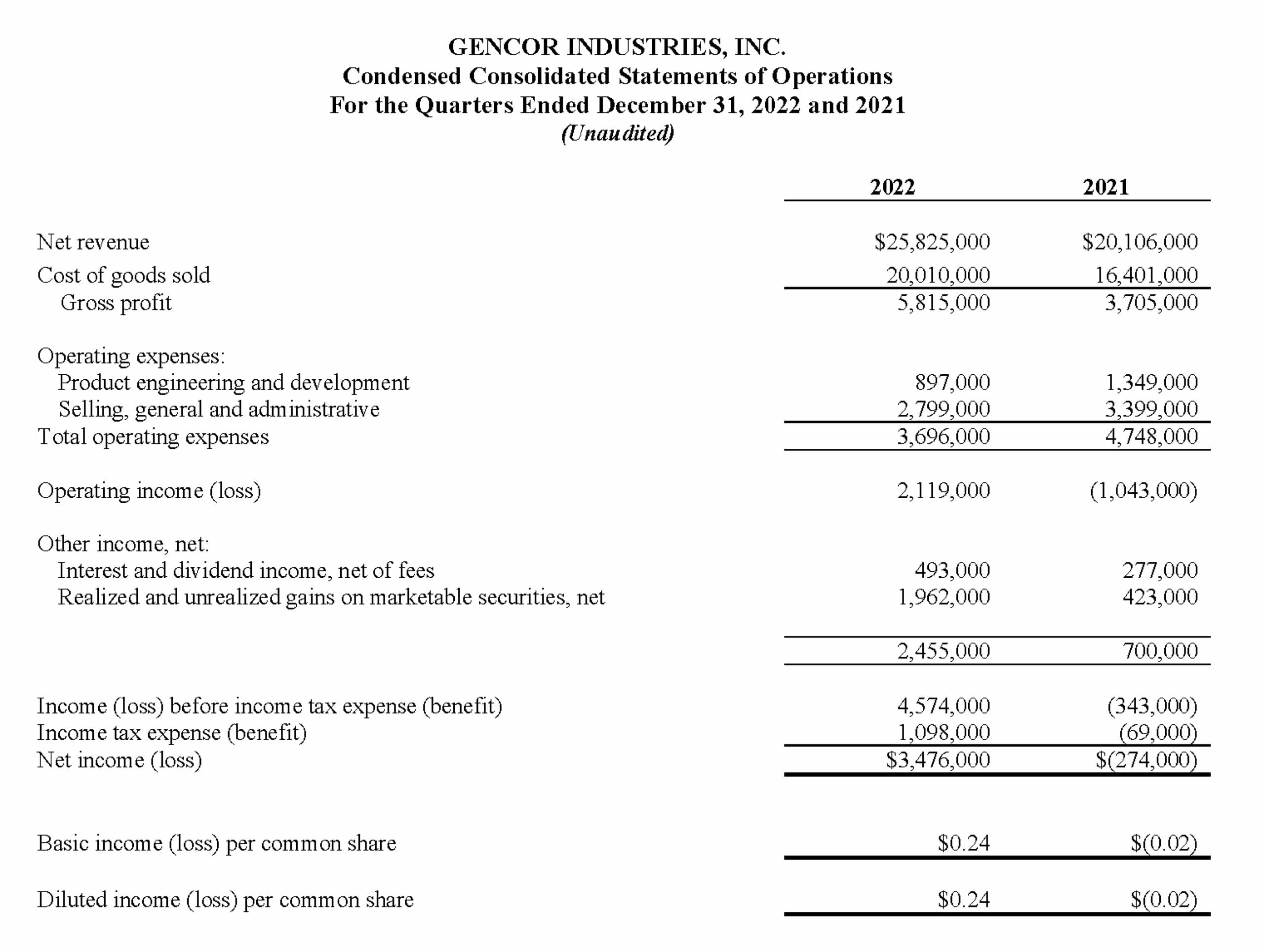

February 10, 2023 (PRIME NEWSWIRE) – Gencor Industries, Inc. (the “Company” or “Gencor”) (NYSE American: GENC) announced today net revenues increased 28.4% to $25,825,000 for the quarter ended December 31, 2022 compared to $20,106,000 for the quarter ended December 31, 2021, due to higher contract equipment and parts sales. Gross margins were 22.5% for the quarter ended December 31, 2022 compared to 18.4% for the quarter ended December 31, 2021 on increased production and favorable price realization.

Product engineering and development expenses decreased $452,000 to $897,000 for the quarter ended December 31, 2022, as compared to $1,349,000 for the quarter ended December 31, 2021, due primarily to lower headcount. Selling, general and administrative (“SG&A”) expenses decreased by $600,000 to $2,799,000 for the quarter ended December 31, 2022, compared to $3,399,000 for the quarter ended December 31, 2021. The decrease in SG&A expenses was primarily due to reduced wages and benefits on lower headcount and reduced professional expenses.

The Company had operating income of $2,119,000 for the quarter ended December 31, 2022 compared to an operating loss of $(1,043,000) for the quarter ended December 31, 2021. The improved operating results were due to higher net revenues, improved margins and lower operating expenses for the quarter ended December 31, 2022.

For the quarter ended December 31, 2022, the Company had net non-operating income of $2,455,000 compared to $700,000 for the quarter ended December 31, 2021. Included in net non-operating income for the quarter ended December 31, 2022 were net realized and unrealized gains on marketable securities of $1,962,000 compared to $423,000 for the quarter ended December 31, 2021. The higher gains in fiscal 2023 were due to a stronger domestic stock market during the quarter ended December 31, 2022.

The effective income tax rates for the quarters ended December 31, 2022 and December 31, 2021 were 24.0% and 20.0%, respectively. The higher tax rate in fiscal 2023 is due to an anticipated reduction in R&D tax credits, effective for the Company’s fiscal 2023. Net income for the quarter ended December 31, 2022 was $3,476,000, or $0.24 per basic and diluted share, compared to a net loss of $(274,000), or $(0.02) per basic and diluted share for the quarter ended December 31, 2021.

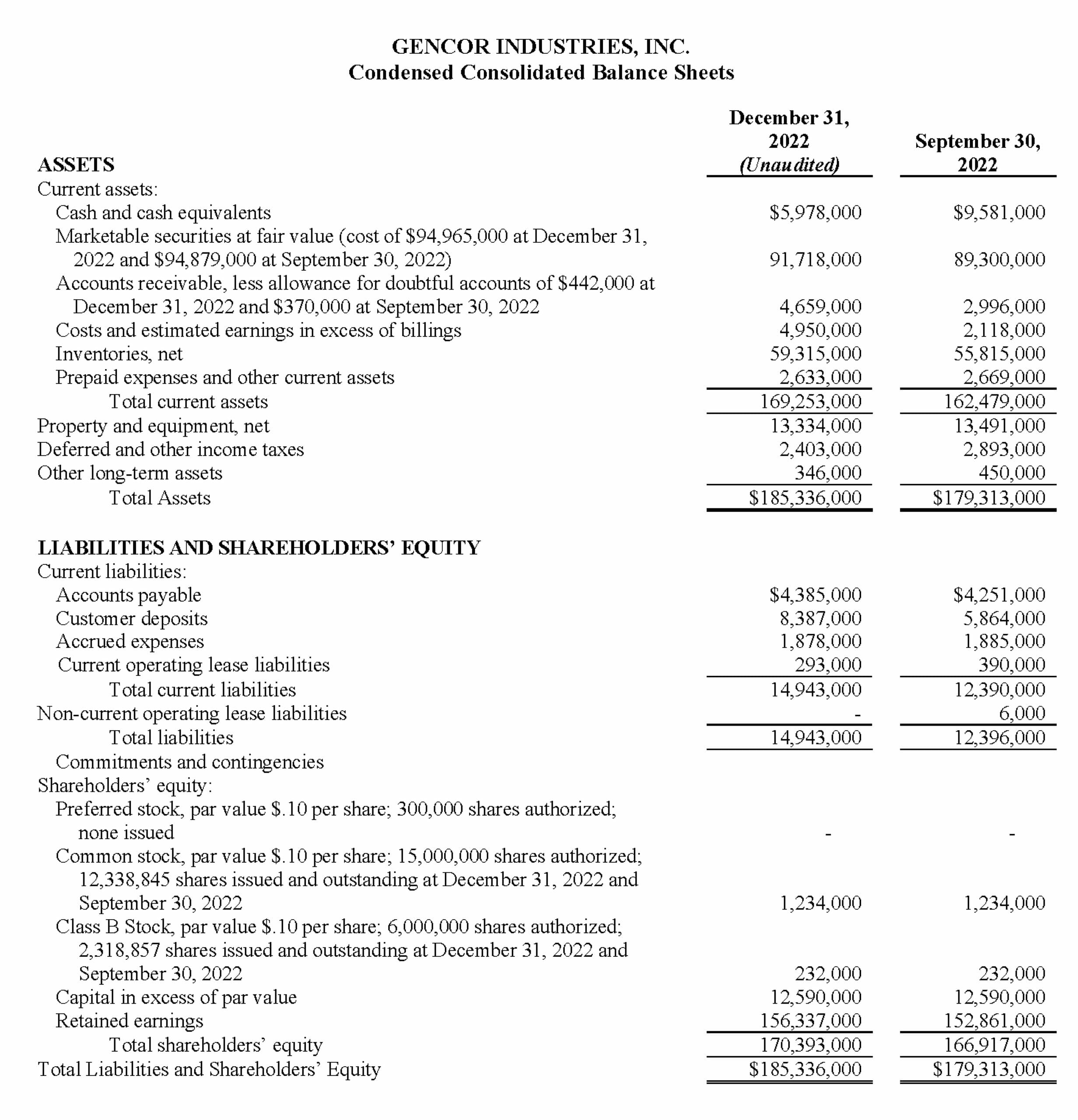

At December 31, 2022, the Company had $97.7 million of cash and marketable securities compared to $98.9 million at September 30, 2022. Net working capital was $154.3 million at December 31, 2022 compared to $150.1 million at September 30, 2022. The Company had no short-term or long-term debt outstanding at December 31, 2022.

The Company’s backlog was $42.5 million at December 31, 2022 compared to $58.0 million at December 31, 2021.

Marc Elliott, Gencor’s President, commented, “Our first quarter revenues grew approximately 28% year to year and 12% sequentially from the fourth quarter of fiscal 2022. I am pleased to see Gencor starting off the fiscal year with significant top-line growth and a solid backlog. Our vigorous quoting activity and keen interest in Gencor products portend a good second quarter, as we prepare to close new business in the coming weeks.

Our first quarter gross margins also improved to 22.5% due to stabilization of our material prices and price realization, but were offset by higher wages. Erratic supply chain issues continue to impact our manufacturing processes, but we remain vigilant in minimizing the disruption to our customers.

We are looking forward to exhibiting at the ConExpo-Con/Agg show in March and expect a healthy reception for our latest product innovations. I am proud of the hard work and dedication of our Gencor employees that delivered these solid results, and continue to identify opportunities to improve our performance.”

Gencor Industries, Inc. is a diversified heavy machinery manufacturer for the production of highway construction materials and equipment and environmental control machinery and equipment used in a variety of applications.

Caution Concerning Forward Looking Statements – This press release and our other communications and statements may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the Company’s beliefs, plans, objectives, goals, expectations, estimates, projections and intentions. These statements are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond the Company’s control. Actual results may differ materially depending on a variety of important factors, including the financial condition of the Company’s customers, changes in the economic and competitive environments, demand for the Company’s products, the duration and scope of the coronavirus (“COVID-19”) pandemic, actions governments, and businesses take in response to the COVID-19 pandemic, including mandatory business closures; the impact of the pandemic and actions taken on regional economies; the pace of recovery when the COVID-19 pandemic subsides. In addition, on February 24, 2022, Russian forces invaded Ukraine. The impact to Ukraine as well as actions taken by other countries, including new and stricter sanctions imposed by the U.S. and other countries and companies against officials, individuals, regions, and industries in Russia, and actions taken by Russia and certain other countries in response to such sanctions, could result in a disruption in our supply chain and higher costs of our products. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and similar expressions are intended to identify forward-looking statements.

For information concerning these factors and related matters, see the following sections of the Company’s Annual Report on Form 10-K for the year ended September 30, 2022: (a) Part I, Item 1A, “Risk Factors” and (b) Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. However, other factors besides those referenced could adversely affect the Company’s results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by the Company herein speak as of the date of this press release. The Company does not undertake to update any forward-looking statements, except as required by law.

Unless the context otherwise indicates, all references in this press release to the “Company,” “Gencor,” “we,” “us,” or “our,” or similar words are to Gencor Industries, Inc. and its subsidiaries.

Contact: Eric Mellen, Chief Financial Officer

407-290-6000