Feb 5, 2018

GENCOR RELEASES FIRST QUARTER FISCAL 2018 RESULTS

FOR IMMEDIATE RELEASE:

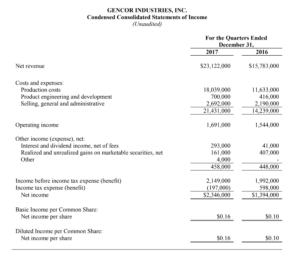

February 2, 2018 (PRIME NEWSWIRE) – Gencor Industries, Inc. (Nasdaq: GENC) announced today net revenues increased 46% to $23.1 million for the quarter ended December 31, 2017 compared to $15.8 million for the quarter ended December 31, 2016. Gross margins were 22.0% for the quarter ended December 31, 2017 compared to 26.3% for the quarter ended December 31, 2016 as the Company increased its manufacturing overhead to support the significantly higher production, as annual revenues have doubled over the past two years. Product engineering and development expenses increased $284,000 to $700,000 for the quarter ended December 31, 2017 due to increased staffing to meet the higher demands for our engineered products. Selling, general and administrative (“SG&A”) expenses increased $502,000 to $2,692,000 for the quarter ended December 31, 2017. Headcount additions, higher sales commissions and increased advertising and trade show expenses to capitalize on the renewed optimism within the highway construction industry contributed to most of the increase in SG&A expenses. Operating income for the quarter ended December 31, 2017 was $1.7 million compared to $1.5 million for the quarter ended December 31, 2016.

For the quarter ended December 31, 2017, the Company had non-operating income of $0.5 million compared to non-operating income of $0.4 million for the quarter ended December 31, 2016. The 2017 tax benefit resulted from the adjustment to the net deferred tax liability and applying the lower corporate tax rates to comply with the recently enacted U.S. tax law, Tax Cuts and Jobs Act (“TCJA”). Net income for the quarter ended December 31, 2017 was $2.3 million, or $0.16 per basic and diluted share, compared to net income of $1.4 million, or $0.10 per basic and diluted share for the quarter ended December 31, 2016.

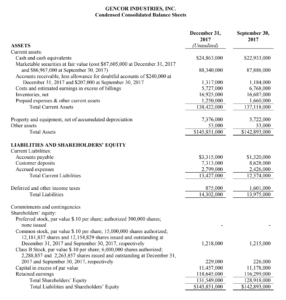

At December 31, 2017, the Company had $113.2 million of cash and marketable securities, an increase of $2.4 million over the September 30, 2017 balance of $110.8 million. Net working capital was $125.0 million at December 31, 2017. The Company had no short-term or long-term debt outstanding at December 31, 2017.

The Company’s backlog was $50.2 million at December 31, 2017 compared to $40.8 million at December 31, 2016.

John Elliott, Gencor’s CEO, commented, “First quarter revenues of $23.1 million represent the best start to our fiscal year in over twenty years. We have a positive outlook which is supported by favorable market conditions and the recently enacted U.S. tax law legislation: Tax Cuts and Jobs Act. The Fixing America’s Surface Transportation Act (FAST Act) and plans to increase domestic infrastructure spending at the Federal level have resulted in an increase in asphalt plant orders and quoting activity. We also anticipate being a beneficiary of lower corporate tax rates and the accelerated tax deduction on capital purchases as a domestic manufacturer and purchaser of capital equipment.

We are pleased with our 46% sales increase in the first quarter, which is traditionally our lowest revenue quarter. Our customers continue to place large orders as domestic highway construction spending remains strong. Net income in the quarter was enhanced by the changes to U.S. tax legislation, specifically a reduction in corporate tax rates on deferred tax liabilities and acceleration of tax depreciation on capital expenditures.

In the first quarter gross margins declined as the company increased its manufacturing overhead to support the significantly higher production, as revenues have doubled over the past two years. The company also accelerated its capital purchases in the first quarter to maximize the tax benefit due to anticipated lower future tax rates. Gencor will continue to invest in its operations to improve efficiencies and meet the strong demand for its products.

Backlog of $50.2 million is 23% higher than the prior year and represents continued optimism from highway contractors that the Federal government and many states are once again focused on investing in America’s infrastructure. We look forward to growth and continue to evaluate opportunities to expand our existing businesses.

In March we will be exhibiting at the 2018 World of Asphalt show where we anticipate significant interest in our products.”

Gencor Industries is a diversified heavy machinery manufacturer for the production of highway construction materials, synthetic fuels and environmental control machinery and equipment used in a variety of applications.

Caution Concerning Forward Looking Statements – This press release and our other communications and statements may contain “forward-looking statements,” including statements about our beliefs, plans, objectives, goals, expectations, estimates, projections and intentions. These statements are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond our control. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and similar expressions are intended to identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. Our actual future results may differ materially from those set forth in our forward-looking statements. For information concerning these factors and related matters, see our Annual Report on Form 10-K for the year ended September 30, 2017; (a) “Risk Factors” in Part I, Item 1A and (b) “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7. However, other factors besides those referenced could adversely affect our results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by us herein speak as of the date of this press release. We do not undertake to update any forward-looking statement, except as required by law.

Contact: Eric Mellen, Chief Financial Officer

407-290-6000